Have you ever considered how you could tap into the equity your property provides? Aside from the existing loans in the market, equity loans are a great way for you to get funds for your child’s tertiary education or for home improvements. Synonymous with “cash out refinancing” and “term loan”, equity loans can be incredibly helpful for you to access the value appreciation of your property. But is it suitable and accessible for you? This article gives you a rundown of equity loans – the pros and cons, and everything in between.

What is an equity loan?

To unlock additional equity from the property for investment purposes, equity loans provide you with a line of credit that is based on the difference between what your house could sell for and your outstanding loans. Be it your business expansion plans or legacy planning, this can provide additional liquidity by using the equity of your property as collateral.

This is particularly helpful if the value of your property has risen significantly since you purchased it as it allows for a greater margin of loan quantum.

Who can get an equity loan?

While enticing, only private property owners with properties that have obtained Temporary Occupation Permit (TOP) are eligible for home equity loans. Unfortunately, this is not an option for HDB homeowners. As for owners of Executive Condominiums, they are eligible after fulfilling the Minimum Occupancy Period (MOP) of 5 years.

Additionally, you have to take your equity loan from the same bank as your current bank loan if you still have outstanding bank loan for your mortgage. It is also notable that only cash is allowed for the repayment of monthly installments.

Following Mortgage Equity Withdrawal Loan Rules set by Monetary Authority of Singapore (MAS), the loan tenure is between your age and 75, but capped at 35 years. The borrowers must also be 35 or younger.

Although MAS states that there is no limit on the Total Debt Servicing Ratio (TDSR) if the loan quantum is 50% or less of that property’s current market valuation, banks usually still apply TDSR or their own ratios to determine loan eligibility.

How much can I borrow?

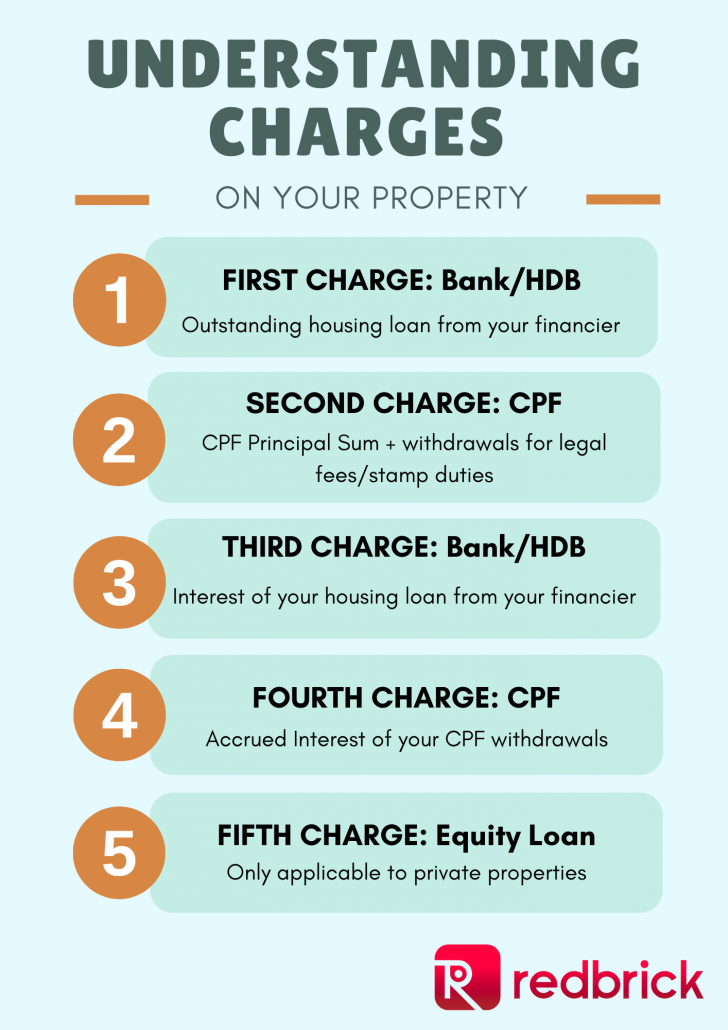

Before we jump into the loan quantum you could borrow using an equity loan, it is paramount that we first understand the concept of charges.

Since you are likely to have used your property as collateral for multiple uses, each lender has a charge on your property. This means that in the event you are unable to repay them, their charge would indicate the order of them getting the monies from the auction of your property.

Since equity loan is the 5th charge on your property, which means that they can only claim from your sale of property after the bank has received your outstanding housing loan and CPF is paid the principal sum and accrued interest. As such, the bank faces a higher risk in lending you the equity loan as compared to a regular housing loan.

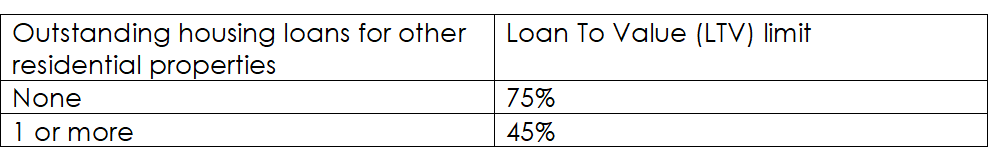

Therefore, banks would be willing to loan you a lower amount and would base it on the amount after repaying the other prioritized charges. If the only outstanding housing loan you have is on the property you are taking the equity loan on, the assumed amount is at 75% of the market valuation of your property.

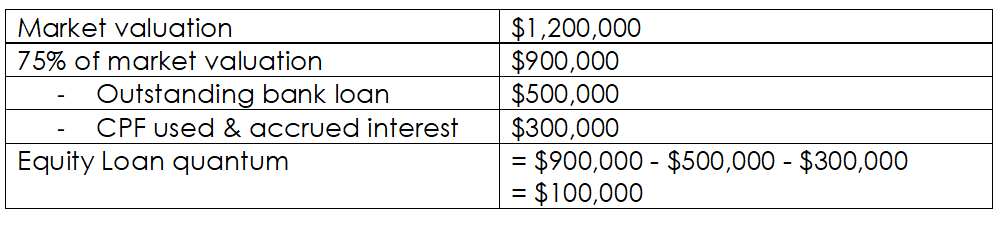

For instance, Mr. Tan bought a condominium valued at 1.2million with an outstanding mortgage of $500,000 as well as used $300,000 of CPF and accrued interest

Mr. Tan would be able to borrow up to $100,000 as an equity loan.

Should I get an equity loan?

1. Purpose of loan

Equity loans will come in helpful if you need a lump sum of money for renovation or financing your child’s university fees. Tapping into the equity in your property allows you to use the cash on whatever needs that arise at lower interest rates.

However, it would be unwise to borrow for frivolous purposes given the severe repercussions of not repaying the loan.

2. Other costs involved

Due to the additional administrative and legal costs involved in the property valuation, upfront costs range between $2000 to $3000. For a 100k loan, this is no small sum at 3% of the loan amount! This also suggests that the interest rates you are paying for the loan is much higher.

For instance, having $3000 upfront costs would mean that you effectively get only 97% of a 100k loan. Although the interest charged may be 1%, this is based on the 100k of outstanding loan amount. But in reality, you would be working with 97k, which would mean that you are paying a lot more than the 1% interest rate.

However, some or all of these costs may be subsidized if we are able to refinance the existing loan, together with the application of the additional equity term loan with another bank.

3. Consequences of not repaying

While enticing given the low interest rates, homeowners should be certain of their capability to repay the loan since they are putting their home up as collateral and unlike other home loans, equity loans can only be repaid with cash. In other words, failing to pay your equity loan goes beyond bad credit scores, and might result in detrimental consequences which might include losing your residence. The high stakes of not repaying also explains why the interest rates are lower. If you are eligible for an equity loan but unsure of whether it is the best option for you, you may want to speak to one of our mortgage advisors.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!